The Coming Telecom Monopoly

The 2G judgment and Trai spectrum pricing recommendations have led to a policy that makes sense for only one survivor.

Shyam Ponappa's column was published in the Business Standard on May 3, 2012

The Telecom Regulatory Authority of India, or Trai, has delivered a stunning blow to the telecom sector in the form of its spectrum pricing and refarming recommendations. The sector was already reeling from scandals and misgovernance, and staggered by a confused Supreme Court judgment based on inappropriate assumptions (for details, see “Time for a review”, March 1, 2012, and “Open access is the future,” March 4, 2012). This will cripple an erstwhile sunrise sector that drove (and still can) India’s prosperity through productivity, enabling many factors to converge positively — such as its economic momentum, enterprise, resilience and, most important, a demographic bulge that could become a blessing or a curse. This convergence was (and is) possible because of the enabling ability of telecom and broadband to provide access to education, vocational training and continuing education; health care and other public services; and commerce, including the delivery of individual output, within easy reach. All this is stalled, as we deliberately disembowel ourselves, as it were.

If Trai’s recommendations are implemented, they will ensure that a lone survivor dominates the sector, annihilating all significant competitors – Bharti, Vodafone, Idea, Tata, and newcomers like Telenor and Sistema – through their having to pay exorbitant fees just to keep their current business going, even without expansion. That is, provided the lawsuits that are likely to follow don’t obliterate everything for the next 10 years.

Are these setbacks happenstance, heaven-sent, or acts of man? Analysing the components shows that much is attributable to the machinations of men, although rendered by different individuals or groups under varying compulsions. The afflictions that began with cronyism and misgovernance have been aggravated by a judgment based on misapprehensions regarding: (a) spectrum technology; (b) the economics of auctions and; (c) competition in network economies.

In trying to get at the corrupt nexus of corporations, politicians, bureaucrats, and just plain crooked people, indiscriminate zealotry is destroying legitimate enterprise. The judgment lumps the guilty with the circumstantially proximate. Coupled with defining auctions as best for the public interest, this set the stage for what has followed. The furore over corruption and the Anna Hazare movement ensure that any objective recommendation would come under fire, with a mobocracy baying for revenge.

Is being deprived of ubiquitous, reasonably-priced broadband so devastating? Yes, because of broadband’s great potential in India’s vastness for enabling people at relatively low cost, compared with, say, fixing energy supply, or sanitation and water, or roads, or growing food. All these are necessary; but broadband is much easier to achieve, at lower cost, and would bring it all more easily within our grasp, especially in rural areas.

Performance

Some question the beneficial effect of revenue sharing from the National Telecom Policy, 1999, (NTP-99) suggesting the sector might have done as well or better without the change. Pakistan is cited as an example for growth with auctions. Consider the performance of the sector in both countries.

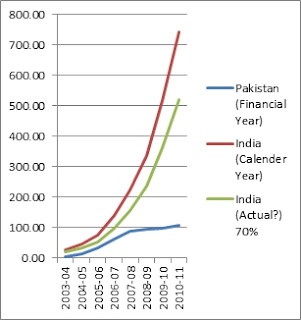

Chart 1 - Mobile Subscriptions (Millions) 2003-2010

(The third line shows India’s numbers reduced to 70 per cent, reflecting an estimate of live subscriptions.)

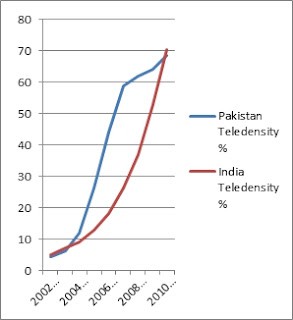

Chart 2 shows the percentage of population served. Pakistan’s coverage grew

Chart 2: Percent Population Covered

Sources: India – TRAI; PIB; http://en.wikipedia.org/wiki/Telecommunications_Statistics_in_India

Pakistan - http://www.pta.gov.pk/index.php

rapidly until about 60 per cent, then tapered off. India started more gradually before accelerating to 60 per cent a couple of years later, and kept going. In March 2011, both were around 70 per cent. At the end of December 2011, India was at 76.86 per cent.

However, there are two major differences. One is the scale of India’s operations. Sheer magnitude makes for much greater complexity, and the achievement is therefore remarkable. The second is the significantly higher government levies in India. India’s telecom sector is perhaps the world’s most heavily burdened, with government collections higher than in Pakistan by 15 to 24 per cent of revenues.* (Compared with China,where government charges are only 3.5 per cent, India’s levies are even more grossly out of line.) Had Indian enterprises not had this burden, it’s conceivable they might have had the capacity and stomach to effectively address rural coverage, especially with the right incentives.

Achieving Ubiquitous Broadband

Now consider what needs doing for countrywide access to broadband, and what odds have to be overcome. First, there’s the addition necessary to rural and semi-urban networks, where almost three times the existing coverage is needed. Much of this needs wireless access. This is why spectrum pricing critically affects outcomes. Many people in India harp on a litany of sunk-costs-not-affecting-tariffs, oblivious to the vast deficiency in network coverage, ie, areas and people without access. It’s like arguing over pricing without any production plant or products. Without capital investments in network coverage, there can be no services, nor any tariffs, high or low. There is little doubt of the effects of high spectrum and licence fees: these needs remain unmet. Hence the low rural teledensity of under 39 per cent at the end of February 2012, with urban coverage at nearly 170 per cent, and overall teledensity at 78 per cent. Separately, there’s the issue of inadequate incentives for broadband delivery.

Statements from Trai and the Department of Telecommunications about the spectrum pricing recommendations being reasonable because of the revenue potential simply don’t add up. Their projections are based on a fantasy of booming growth (like the Budget projection of 7.6 per cent GDP growth, but even more exaggerated). Whereas the combined effect of the scam and its fallout, sentiment, momentum, and misguided efforts at tax-gouging will ensure that telecom revenue growth is no more than a stunted five to seven per cent, at best. No bank will lend seven-year funds in such uncertain circumstances to what was once a sunrise sector — but is now like heavy infrastructure, with a need for 20-year financing. Add the costs and difficulty of refarming the 900 MHz spectrum, and one has to wonder: who is going to bid, and why? It makes sense only for one survivor. All this is aside from the extension of subsidised non-performance at the PSUs, instead of transforming them into anchors of an open-access national network.